How to Build a Fintech App

Nowadays, an ever-increasing number of industries go digital. Banks and financial institutions are moving in the wake of this high-tech drive, leveraging fintech solutions – state-of-the-art software working in the financial sector. This domain displays a spectacular annual CAGR of over 9% and is expected to top $158 million by 2023

Companies offering high-tech financial services are in constant search of new channels in their attempts to reach out to the global pool of consumers. One of the most promising means of customer engagement in the early third millennium is mobile phones. That is why the question “how to build a fintech app?” is becoming a topical one for financial institutions having big-time aspirations.

Starting with the Basics: What is a Fintech App?

The across-the-board headway of IT advancements was boosted by the global pandemic that has started the “remote everything” trend in almost all spheres of our life. So, during the last couple of years, we have come to rely heavily on digital technologies in shopping, entertainment, education, healthcare, and dozens of other spheres with financial services being one of them.

Today, you don’t have to visit a brick-and-mortar bank to withdraw money or pay for an order at a pizza place. All these and plenty of other services can be enjoyed by downloading various fintech apps – IT products that you can install on your smartphone and manage your finances in several clicks.

What makes developing a fintech app an appealing investment prospect?

Why Creating a Fintech App is Worthwhile?

Being a seasoned player in the niche of mobile development, we at Requestum see the following top four reasons why launching a fintech app can be a good business idea.

1. The omnipresence of mobile phones

It wouldn’t be an exaggeration to claim that almost every person today has a mobile phone. Moreover, the global number of these gadgets people possess is twice as much as the total population of the Earth and is continuing to grow.

2. The rapid emergence of open banking

Digitalization in the banking sector is on a robust rise with financial organizations moving their virtual storefronts at every person’s fingertips. Moreover, there is a mutual understanding among the financial agents that they should keep the open policy and stay in constant contact, enabling their clients to get access to each other’s services and being friendly to multiple third-party integrations.

3. Widespread financial illiteracy

Strange as it may sound in the 21st century but our financial literacy is at a rather low level. Even in highly developed countries (such as the USA) more than half of the population has serious problems in managing their finances. One may think that this is symptomatic of older people but statistics show that over three-fourths of American millennials admit inadequate financial education which causes pessimism as to their financial future. Humans are in dire need of AI assistance to tackle financial issues.

Explore the key differences between PWA and Native apps

4. Rarity and limitations of available solutions

Mobile applications in many industries impress users with the imagination their developers display while creating them. We may see it in educational, healthcare, e-commerce, and other app categories – but hardly any fintech software.

It’s a shame to confess it but many financial business owners who want to build a fintech app have a rather limited vision of its functionalities. As often as not, the product they commission turns out to be a boring solution supporting mobile payments and money transfers. Creativity is still a much-wanted quality in the domain so if you have some unusual ideas as to the field of its employment or unique services to offer to customers you have all the chances to capitalize on your specific approach.

Given the wide range of financial services rendered by banks, it is natural that the scope of fintech applications you can try your hand at is broad too.

Types of Fintech Apps Explored

What are the most attractive niches for contemporary fintech application development efforts?

1. Mobile payment apps

This is the most popular fintech app type by far. Employing it you can make purchases or accept payments without having to leave your premises or from any place you find convenient (provided there is an internet connection). When you do go shopping, taking along your wallet isn't necessary at all – you will be able to pay with your smartphone containing the respective app.

2. Wealth management apps

These applications will let you not only spend but earn as well. Now, anyone can perform stock investment and trade transactions from the comfort of their COVID-proof apartment. Apps of this kind can be honed for various categories of people – from budding stockbrokers to NYSE experts. And while you polish your skills in the industry, you can switch from one to the other keeping pace with your competence progress.

3. Insurance apps

If you opt for this type, you will be engaged not in building a fintech app but in building its close relative – an insurtech app. Using it, people can insure their life, health, chattels, real estate, or even digital data – anything they value and would be sorry to lose. Plus, the entire gamut of related services (like getting insurance quotes or filing claims) can be made available via such software products.

4. Budgeting apps

With these apps, managing personal finances and controlling spending becomes so easy. Now you don’t have to collect checks or try to come to grips with cumbersome excel spreadsheets. By installing a budgeting app you will be able to balance profits and expenses and reduce needless spendings that sap your finances.

The most cutting-edge budgeting apps are powered by AI technologies used in the process of fintech apps development so that you get a virtual robo-adviser that would analyze your expenditures, detect patterns and trends, identify loopholes, and provide round-the-clock asset management recommendations that are sure to augment your financial efficiency.

5. Lending and crowdfunding apps

Getting money for your needs has never been easier than it is now with such apps. It can be loans obtained from banks or funds received from various donators and pooled at one venue to finance your projects – it doesn’t matter. What matters is the ability to procure financing quickly which is of high value for startups and other budding entrepreneurs.

6. Cryptocurrency and blockchain apps!

Specialists and laymen are far from having a common attitude to these breakthrough phenomena but they have largely become a part of our next normal. Naturally, an increasing number of people would like to use cryptos in their financial transactions.

Apps allowing operations with virtual currency offer essentially the same services as with fiat money including investments, payments, wallets, etc.

7. Neobank Apps

In any sphere, there are always certain groups of clients whose interests aren’t covered via conventional banks. Small apps can cater to the needs of freelancers, immigrants, e-commerce agents, and other specialized underbanked categories of consumers of financial services.

Whatever the type of the app might be, it is essential to make sure it has some mission-critical features.

Must-Have Features of a Fintech App

Experts of Requestum have a wealth of experience in mobile app development so we know well what any high-end solution can’t do without:

-

Simplicity. Since the financial sphere is rather complicated in itself it is a bad idea to make it yet more perplexing by unleashing an over-sophisticated app for the average user. Its UI and navigating through the app should be as foolproof as possible not to scare off ordinary people. So while creating it, don’t steer by the image of a geek easily finding his way around the app. Instead, try to picture your mother or uncle trying to figure out how it works.

-

Personalization. Each user wants to experience a personal touch. Everybody appreciates when they are treated not just as another guy out there but as a unique individual with their problems and needs. How can it be achieved in a fintech app?

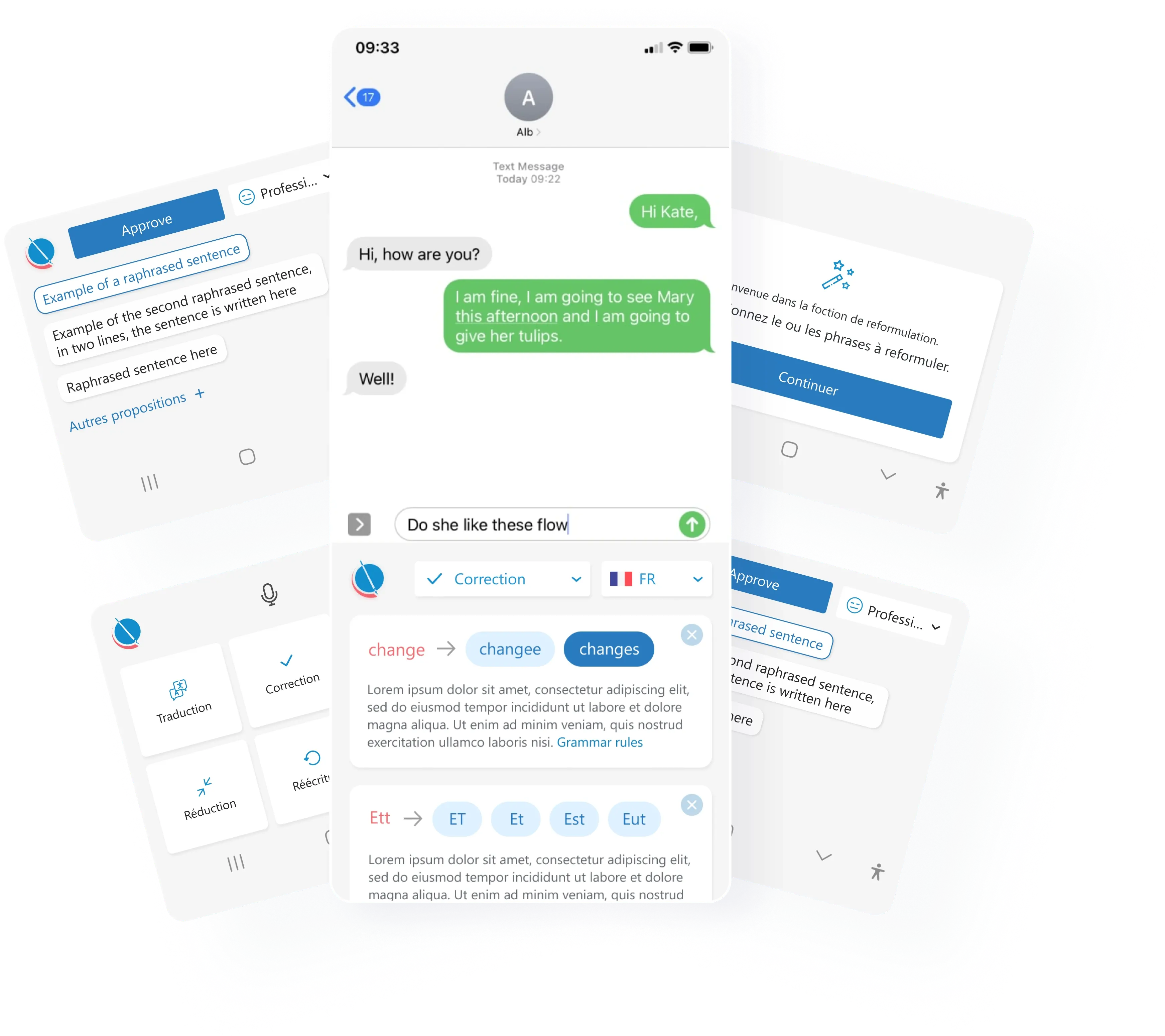

Case Study: Scribens

You can make the best of personalization by implementing AI-powered features into the final product. It will analyze the app user’s behavioral patterns and depending on thus individualized input provide recommendations and focus on benefits that would suit this very customer.

- High-profile security. When it goes about money, crowds of scoundrels get excited trying to discover ways to lay their hands on it. In the IT-sphere, it means directed cyber attacks and data breach attempts. That is why fintech app creators should take maximum care their users’ personal and financial dossiers are protected from such hacker depredations by introducing biometric authentication and data encryption.

-

Payment gateway integration. The cornerstone of any fintech solution is handling payments so enabling PayPal, Stripe, or any bank APIs will enhance the payment functionality.

-

Push notifications. Keeping users informed on the updates and novelties in policies as well as on upcoming discounts or promotions is an essential component of a satisfying UX customers get while interacting with the app. By implementing the push notification functionality, you will ensure a permanent and timely communication channel between bank officials and clients.

Now when you know what to equip your fintech app with you can get down to building it.

Fintech App Development in 7 Stages

Our approach to creating mobile apps has allowed us to map out a no-sweat algorithm employed for this task.

Step 1. Discovering a niche

Before diving deeper into the development process, you should be aware of your future client and try to see what problems of theirs your product will solve. It means deciding upon the type of your future app and the basic parameters it is going to have.

Step 2. Watch for compliance with legal requirements

You wouldn’t like your customers to get into legal trouble by involuntarily violating some regulation or decree, would you? Then make sure your future software piece is compliant with all security and privacy standards in the realm.

Step 3. Define the app’s features

At this stage, you should shape the general vision of your product which presupposes determining the list of features it will have. You must avoid crowding tons of characteristics into it that later will be of little use for customers. Instead, focus on the crucial ones.

Step 4. Recruit an adequate crew

The nature of your app and the features it will possess condition the composition of the development team you will need for the project. As our experience shows, creating a variety of fintech apps will require the participation of front-end and back-end developers, UI designers, QA specialists, developers competent in two basic operating systems (iOS and Android), and a business analyst. And of course, the team should be headed by a skilled project manager.

Step 5. Prioritize UX and UI design

While building a fintech app it is important to realize that its ultimate goal is to keep the consumer satisfied. Naturally, all developing efforts should be turned in this direction which means producing a user-friendly UI and easy-to-navigate app architecture.

We at Requestum achieve it by creating several prototypes to compare their usability and determine which will be the best fit for the commissioned project.

Step 6. Build an MVP

Minimal Viable Product serves to test the future solution and identify its bottlenecks before it is put to mass production. In this way, you will see how smooth is its functioning and, broadly speaking, whether the concept is workable.

Step 7. Eliminate exposed issues and provide the app’s support

Even when the app is completed and deployed, it is not the time for you to rest. Our company always reacts to the reviews of users, adding features at the request of the customer, updating it, and ensuring its seamless functioning.

When technical and organizational issues are taken care of, it is time to give thought to the question of the cost.

Let’s build software tailored to your needs

Evaluating the Cost of Building a Fintech App

How can you define the sum of money you will have to fork out for creating a fintech app? Two factors influence the final amount.

The first is the scope of features you would like to see in your solution. Naturally, the more extensive is the list, the more expensive it will turn out since developers will spend a long time building everything you have ordered.

The second factor is the hourly rate charged by vendors for their services. The price depends on the location of the company. Developers from North America and Western Europe have the highest rates while their counterparts from Eastern Europe charge much less without compromising the quality.

Thus, a high-end app created in the USA would cost you around $100,000 whereas for the same app produced by, say, a Ukrainian company you are likely to pay not more than $40,000. So if you want to cut down on expenditures, it makes sense to look for developers in these quarters.

Final Thoughts

The fintech industry is an extremely lucrative sphere that is on a constant rise and is sure to grow in the foreseeable future as the digitalization drive pushes the technological envelope. That is why investment in creating a high-demand fintech app will bring a steady inflow of profits into your company’s coffers.

However, you should choose the developer with utmost care. The seasoned team of Requestum has sufficient expertise in developing top-quality software products that will impress you with impeccable functioning and elegant design. Contact us to hire a dedicated team of developers for your project.

Our team is dedicated to delivering high-quality services and achieving results that exceed clients' expectations. Let’s discuss how we can help your business succeed.

SHARE: